How To Create A Break Even Chart In Excel

Excel Break-Even Analysis

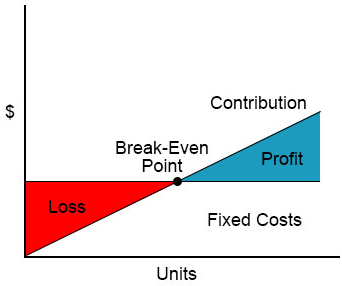

In simple terms, the break-even point is where our total cost is equal to the total revenue earned, so we can call this situation as "no profit no loss". In graphics, the break-even point is where revenue total and total cost curves meet.

All the business models estimate their revenue and expenditure for the year, quarter, and month to know what is their break-even point in the business. In this article, we will show you how to calculate the "Break-Even" Analysis in excel.

So Break Even is Revenue – Total Costs = 0

In economics, we call the break-even point as "the point of indifference," and this analysis informs the management to know what is the minimum revenue required to cover its expenses.

The calculation of Break-Even points is different for the industry to industry. If the company is a Product selling company, then the number of units sold will be considered, and if the company is a Services Company, then it will be a different strategy.

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Break-Even Analysis in Excel (wallstreetmojo.com)

How to do Break-Even Analysis in Excel?

You can download this Break Even Analysis Excel Template here – Break Even Analysis Excel Template

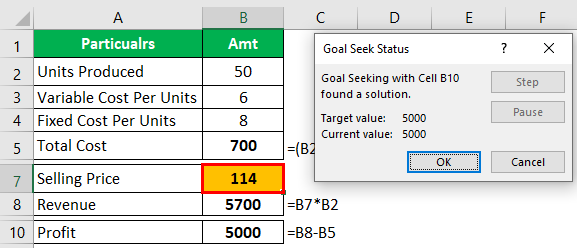

Example #1 – Using Goal Seek Tool

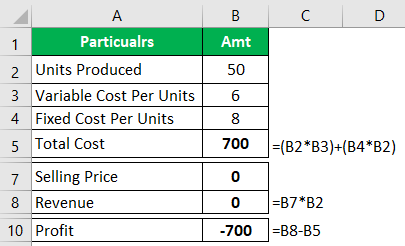

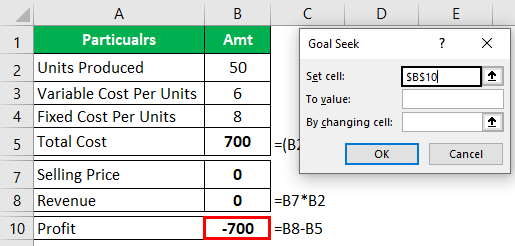

Company A has prepared 58 electronic devices; it has incurred a total fixed cost of 8 Per Unit and a variable cost of 6 per unit. Now this company doesn't know at what price they need to sell these 58 devices to achieve the break-even point.

Construct this scenario in an excel worksheet; if you don't know how to construct, then follow image formulas.

Now to find the break-even point, our profit amount should be zero.

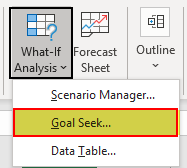

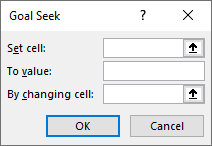

- Open the GOAL SEEK option from the DATA tab under What-If-Analysis in excel What-If Analysis in Excel is a tool for creating various models, scenarios, and data tables. It enables one to examine how a change in values influences the outcomes in the sheet. The three components of What-If analysis are Scenario Manager, Goal Seek in Excel, and Data Table in Excel. read more .

- Now we can see below the Goal Seek window.

- Set Cell will which cell we need to modify the value; in this case, we need to modify the Profit cell, so select B10 cell.

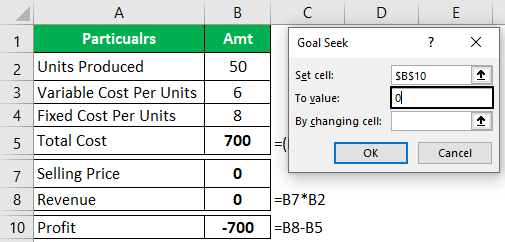

- To Value means the Set Cell value should be what??? In this case, we need the Profit cell to be zero, so enter the value as 0.

- The last option is By Changing cell, i.e., By changing which cell we need the profit value as 0. In this case, we need to find what should be the selling price to achieve the Break-Even point. So select the B7 cell.

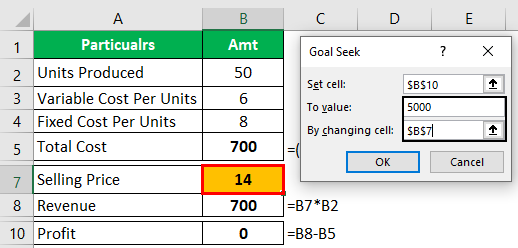

- Now click on Ok, Goal Seek will find the "Selling Price" required to achieve the Break-Even Point.

So, Company A has to sell the electronic devices at 14 per unit to achieve the Break-Even point.

Similarly, using the same Goal Seek analysis, you can find the selling price required to achieve a profit of 5000.

- For this again, open the Goal Seek window and select the Profit Cell for Set cell option, and To Value will be 5000, and By Changing cell will be Selling Price cell, i.e., B7 cell.

- This should give the required Selling Price to achieve 5000 profit.

So in order to achieve a profit of 4000, Company A has to sell at 114 per unit!!!.

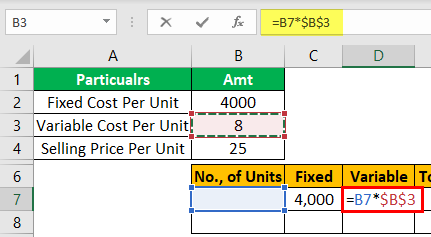

Example #2 – Construct a Break-Even Table

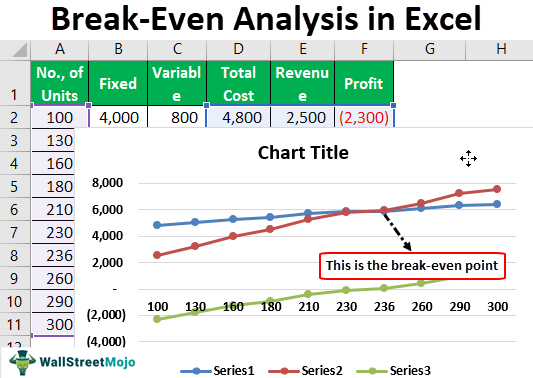

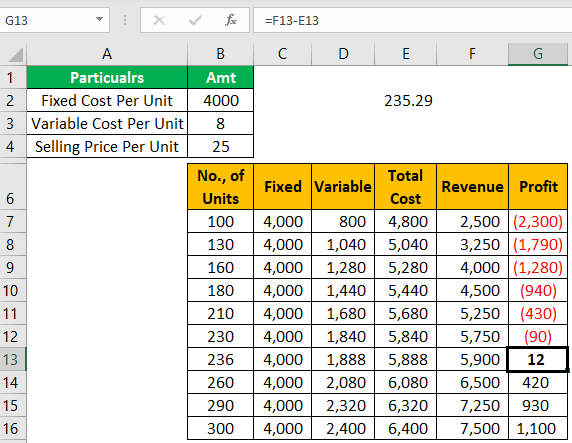

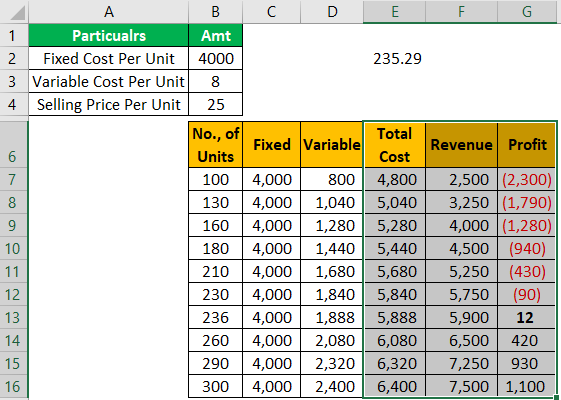

Ms. Alisa is an entrepreneur who produces notebooks, and her costing model is as follows.

- Fixed Cost = 4000

- Variable Cost = 8 Per Unit

- Selling Price = 25 Per Unit.

Now she wants to know how many units she needs to produce to achieve the Break-Even Point. Let's help Ms. Alisa through our excel break-even analysis.

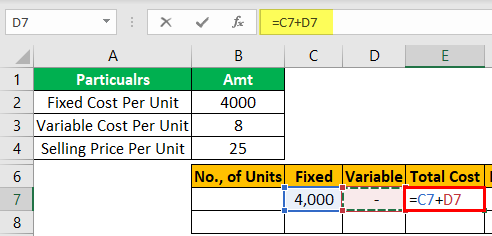

- Now construct a table like below.

- For Fixed Cost Fixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity. read more , Simply give cell link to B2 and make it an absolute reference.

- For Variable, also enter the formula as No. of Units * Variable Cost Variable cost per unit refers to the cost of production of each unit produced, which changes when the output volume or the activity level changes. These are not committed costs as they occur only if there is production in the company. read more Per Unit.

- For Total cost, add "Fixed + Variable."

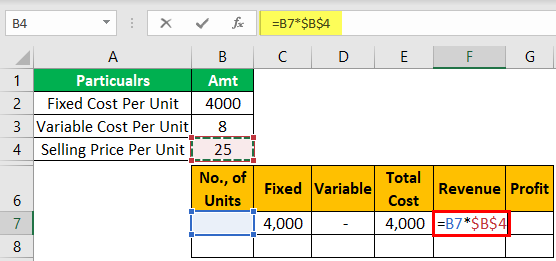

- For Revenue arrive the formula as No. of Units * Selling Price Per Unit.

- For-Profit enter the formula as Revenue – Total Cost.

- Now drag the formula of all the cells to 10 rows.

- Now for No. of Units start filing from 100 to 300.

From the G13th cell, Profit is showing positive numbers, so to achieve Break-Even Point, Ms. Alisa needs to produce approximately 236 units.

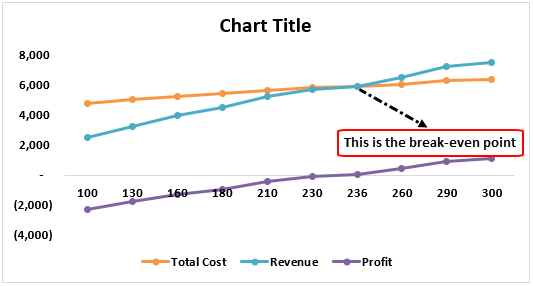

- Now for the same data, let's create Break-Even Chart The break-even chart illustrates the relationship between cost and sales by displaying profit and loss on various quantities for analysis. read more . Select the Total Cost, Revenue, and Profit column for this.

- Insert line chart with markers.

So the point where the curves of "Revenue & Total Cost" intersects is called the Break-Even Point.

Things to Remember

- Break-Even is the point where the business stands at no profit, no loss scenario.

- Break-Even analysis Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost i.e., the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company, its fixed cost, and the variable cost. read more is best suited for the production industry.

- To find break-even in units formula is FC / (SP – VC).

- The intersection point of both revenue & total cost curves is called a break-even point.

Recommended Articles

This has been a guide to Break-Even Analysis in Excel. Here we discuss how to do Break-Even Analysis using goal seek tool and construct a break-even table along with examples and downloadable templates. You may also look at these useful functions in excel –

- Breakeven Analysis Examples

- Break-Even Point in Accounting

- BEP Formula

- Break-Even Sales Calculation

- 35+ Courses

- 120+ Hours

- Full Lifetime Access

- Certificate of Completion

LEARN MORE >>

How To Create A Break Even Chart In Excel

Source: https://www.wallstreetmojo.com/break-even-analysis-in-excel/

Posted by: jonesgrounted.blogspot.com

0 Response to "How To Create A Break Even Chart In Excel"

Post a Comment